|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

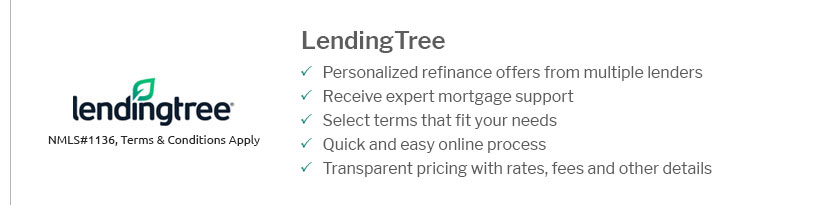

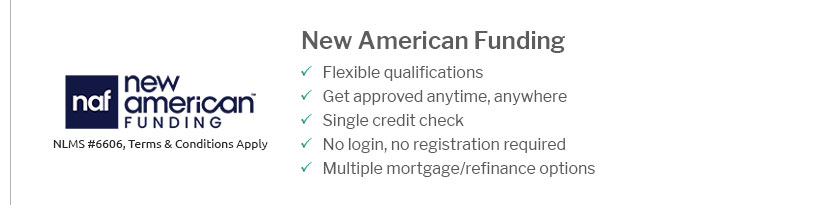

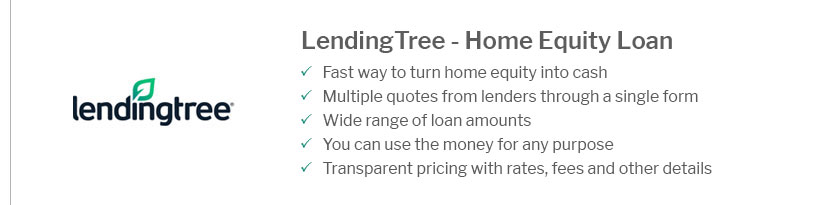

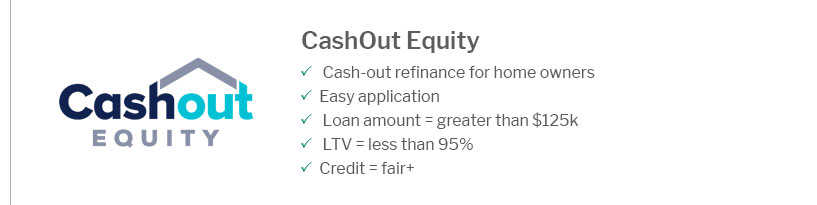

The Top 10 Home Refinance Companies You Should ConsiderRefinancing your home can be a smart financial move, but choosing the right company is crucial. Here, we explore the top 10 home refinance companies, offering you insights into their offerings and services. Understanding Home RefinanceRefinancing involves replacing your current mortgage with a new one, often with better terms. This process can lead to lower interest rates, reduced monthly payments, or a shorter loan term. Top 10 Home Refinance Companies1. Quicken LoansQuicken Loans is known for its customer service and competitive rates. Their user-friendly online platform makes refinancing straightforward and efficient. 2. LoanDepotLoanDepot offers a seamless online application process and a wide range of loan options to suit different refinancing needs. 3. Better.comBetter.com provides a digital-first experience with no commission fees, ensuring a cost-effective refinance. 4. Bank of AmericaBank of America offers various refinancing options with potential discounts for existing customers. 5. ChaseChase provides personalized service and a robust selection of refinance products, ideal for those seeking tailored solutions. 6. Wells FargoWells Fargo is a trusted name, offering a variety of refinance options with competitive rates and terms. 7. US BankUS Bank stands out for its flexible refinance options and commitment to customer satisfaction. 8. PennyMacPennyMac focuses on low costs and extensive loan options, appealing to a wide range of homeowners. 9. SunTrustNow a part of Truist, SunTrust offers personalized refinancing solutions with a strong emphasis on customer service. 10. Flagstar BankFlagstar Bank is known for its diverse loan products and strong support throughout the refinancing process. Important Considerations

To evaluate your potential savings, consider using a mortgage calculator with refinance capabilities. FAQs

https://reliancefinancial.com/top-10-mortgage-refinance-companies-in-united-states/

The top mortgage refinancing companies will provide competitive interest rates, a simple application procedure, and a selection of refinancing options. https://www.goodfinancialcents.com/best-mortgage-refinance-companies/

Company Reviews for Best Mortgage Refinance - Quicken Loans - Better - AmeriSave - loanDepot - Bank of America - Veterans United Home Loans - Chase. https://money.com/best-mortgage-refinance/

Navy Federal Credit Union Best Credit Union; Rocket Mortgage Best Refinance Lender Overall; Zillow Best Marketplace.

|

|---|